Understanding Community Property vs. Separate Property

Making the Law Simpler

Property Ownership in Community Property States

Knowing the difference between community property and separate property is vital when it comes to estate planning. These two property types can also affect family law in the areas of marriage, divorce, and inheritances. We’ll explore what sets community property and separate property apart from each other and why they matter.

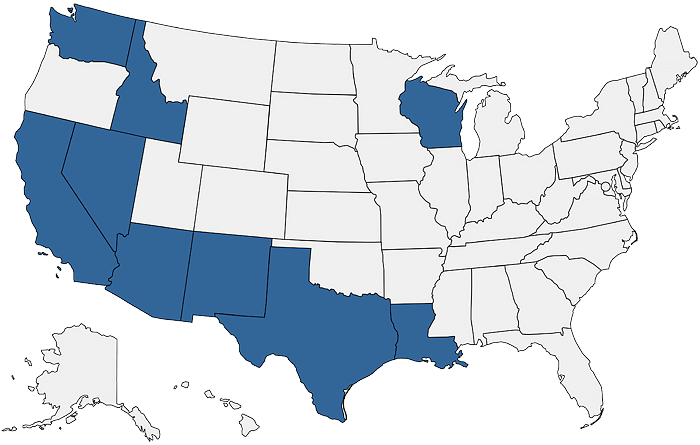

Nine states in the US recognize two types of property when it comes to Family Law: community property and separate property. These states are called community property states.

How can community property laws impact your estate planning?

Community property laws can lead to ownership of your home, business, bank accounts, and other property actually being different than you may think.

Countless people have had their valuable assets end up in the wrong hands after their passing, all because their will didn’t take community property and separate property into account.

Find out if you live or own property in a community property state.

What is Community Property?

Community property is defined as property and assets that are acquired during the course of a marriage by either spouse. Legally, community property is owned by both spouses. It includes various types of assets and income, such as:

- Income earned during your marriage: Any money earned by either spouse during your marriage, including salaries, wages, and business income, is considered community property.

- Property or real estate bought during your marriage: Homes, land, and other real estate acquired while married are generally regarded as community property.

- Capital gains earned on community property: Any increase in the value of assets considered community property, such as investments or real estate, is also shared by both spouses.

- Dividends and interests earned on any property during your marriage: Earnings from investments, bank accounts, or any financial assets acquired during your marriage are typically considered community property.

What is Separate Property?

Separate property consists of assets that are not subject to joint ownership in a marriage. These assets remain owned by the individual spouse who acquired them before the marriage or, in some cases, during the marriage. Separate property can include:

- Income you earned before your marriage: Money earned by a spouse before the marriage remains their separate property.

- Property and real estate you owned before your marriage: Any real estate or property owned by one spouse before the marriage keeps its status as separate property, even if it is used by both spouses during the marriage.

- Capital gains earned on separate property: Any increase in the value of assets that were originally classified as separate property is also considered separate.

- Inheritances or major gifts received before or during your marriage: Inheritances or significant gifts received by one spouse are typically categorized as separate property.

Community Property and Separate Property: A Key Difference

A major difference between community property and separate property becomes clear during estate planning or a spouse’s death.

Division of Community Property

Community property can be divided and after a spouse’s death. In this process, assets are often divided according to a state’s specific laws and the terms outlined in a person’s will.

The Unexpected:

Community property laws can lead to someone else owning part of a surviving spouse’s home, financial assets, or other property, even though that was never the couple’s intention.

The Unexpected:

Complicated situations can arise in such cases. For example, a surviving spouse may discover that they don’t legally own the house they live in or another valuable asset they believed they had jointly owned with their wife or husband.

Separate Property Stays Separate

Separate property remains with the spouse who originally owned it, even after an individual’s passing. It’s not usually divided as part of the estate, maintaining its sole ownership by the spouse who originally acquired it.

Avoid the Unexpected

Understanding these differences can be crucial in planning for the future and safeguarding your assets for those you love. Taking these steps can help too:

Keep Clear Records

To avoid issues, couples should maintain clear records of their financial transactions, including documentation for assets you acquired before and during your marriage.

Talk with an Expert

Consulting with an attorney experienced in estate planning in community property states is also recommended. A trusted attorney will focus on making sure your rights and interests are protected. They can also make sure your property is categorized correctly based on the laws of your specific state, helping you, your spouse, and your heirs avoid the unexpected.

What States Are Community Property States?

The nine community property states are:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

Community property laws may affect you if:

1. You live in one of these nine community property states.

2. You own property in one of these nine community property states.

Explore More Life & Legacy

Life & Legacy Planning

Joint Tenancy vs. Tenancy in Common

Who can assist me if I have more questions?

Whether you’re planning your own estate or helping a loved one with theirs, understanding community property can help you make the best decisions for those you care about.

For questions about community property laws or other estate planning issues, talk with an experienced family law attorney. Bishota Law can help you understand how both work in your state and how to best protect your interests.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this website are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information. No reader, user, or browser of this website should act or refrain from acting on the basis of information on this site without first seeking legal advice from counsel, only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation. Use of, and access to, this website or any of the links or resources contained within the website do not create an attorney-client relationship between the reader, user, or browser and Bishota Law, PLLC. All liability with respect to actions taken or not taken based on the contents of this website are hereby expressly disclaimed. The content on this website is provided “as is;” no representations are made that the content is error-free.

Your Solution

is Waiting for You

We’d love to hear from you!

Yours

is waiting

for you

We’d love to hear from you!

Click here to tell us about the help you need.

We’ll reach out to you with a phone call or text in less than 24 hours.